Despite its centrality to the discussion on tax evasion and tax avoidance, there is no established and stable definition of a “tax haven”. Two approaches coexist: (i) a legal approach aiming at identifying “non-cooperative” jurisdictions in international cooperation to curb tax evasion (OECD Global Forum, EU official list) and (ii) an economic significance approach primarily focussed on Offshore Financial Centres (OFCs) benefiting from tax avoidance flows (OECD, IMF & BIS lists of OFCs, Zucman study, Tax Justice Network index).

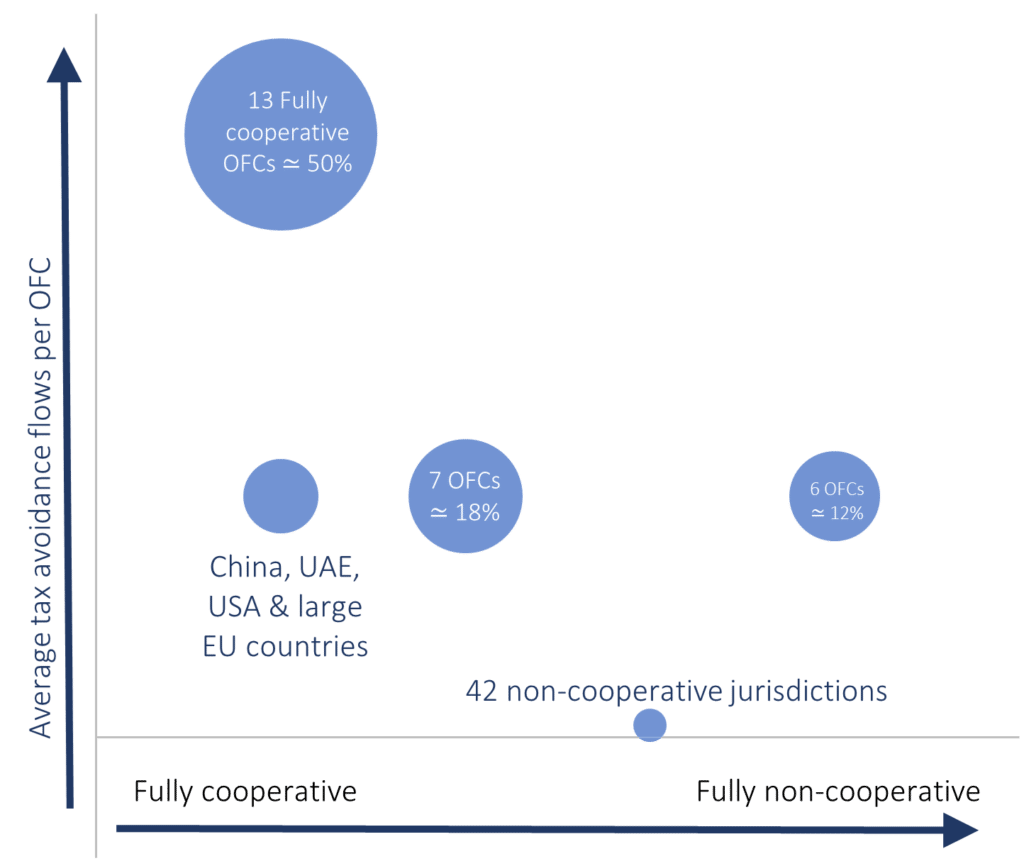

Comparing the two approaches and their respective lists and rating systems, the vast majority of “non-cooperative” jurisdictions on tax evasion have a marginal impact on tax avoidance flows. Conversely, around half of tax avoidance flows appear to benefit OFCs that otherwise are “fully cooperative” when it comes to curbing tax evasion.

International cooperation and exchange of information between tax authorities matter in their own right to help address tax evasion. But they are insufficient to account for the broader problem of tax avoidance, aggressive tax planning and Base Erosion and Profit Shifting practices by multinational enterprises, which require deeper tax reforms.

Regarding tax avoidance specifically, the matter definitely is not limited to small, distant island OFCs. OECD- and European based OFCs play a crucial role. In particular, the ‘NILS’ group – Netherlands, Ireland, Luxembourg and Switzerland – could well account for more than 40% of global tax avoidance flows.