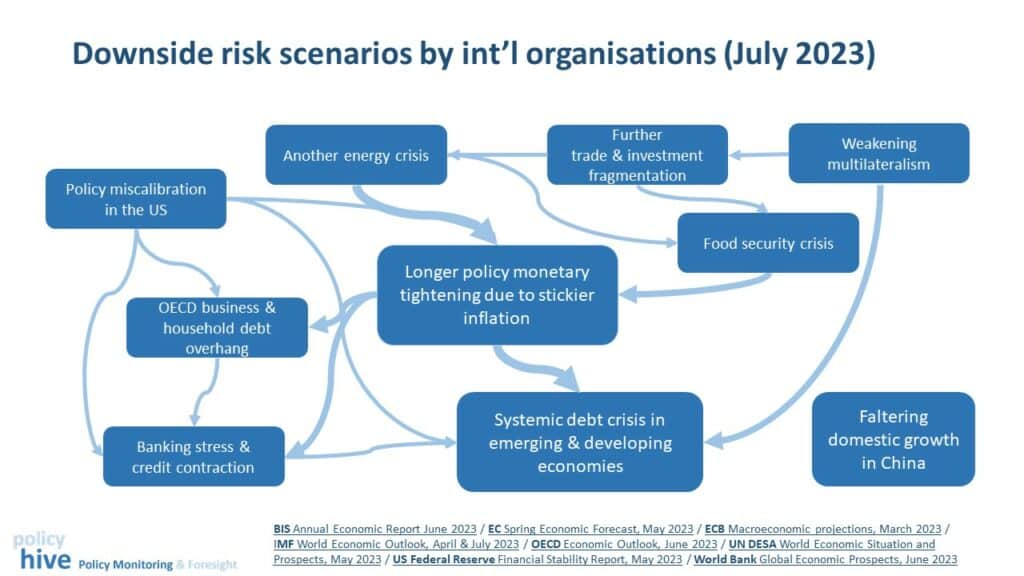

The downside risk scenarios identified in the latest flagship reports by international organisations (IMF, OECD, WB, UN, EC) and central banks (BIS, ECB, US Federal reserve) are recapped in the following flow chart – including where they intersect most.

Overall, the most cited risk scenarios: (i) a monetary tightening that gets out of control because of sticker inflation (ii) a debt crisis in emerging and developing economies.

The risk for another energy crisis is less present, although both the OECD and the EC remain concerned, while the risk for a food crisis is reappearing for the IMF and the OECD.

Among the single impact but large magnitude type of downside risk scenarios, there is: (i) a China rebound that falls short and (ii) a policy event in the US (failure to agree on the debt ceiling, US Fed becoming too hawkish).

Hovering over it all are geopolitical tensions – further fragmentation of global trade and investment and weakening of multilateral institutions – which are more difficult to quantify for economists but are nevertheless significant risks.

BIS Annual Economic Report June 2023 / EC Spring Economic Forecast, May 2023 / ECB Macroeconomic projections, March 2023 / IMF World Economic Outlook, April & July 2023 / OECD Economic Outlook, June 2023 / UN DESA World Economic Situation and Prospects, May 2023 / US Federal Reserve Financial Stability Report, May 2023 / World Bank Global Economic Prospects, June 2023