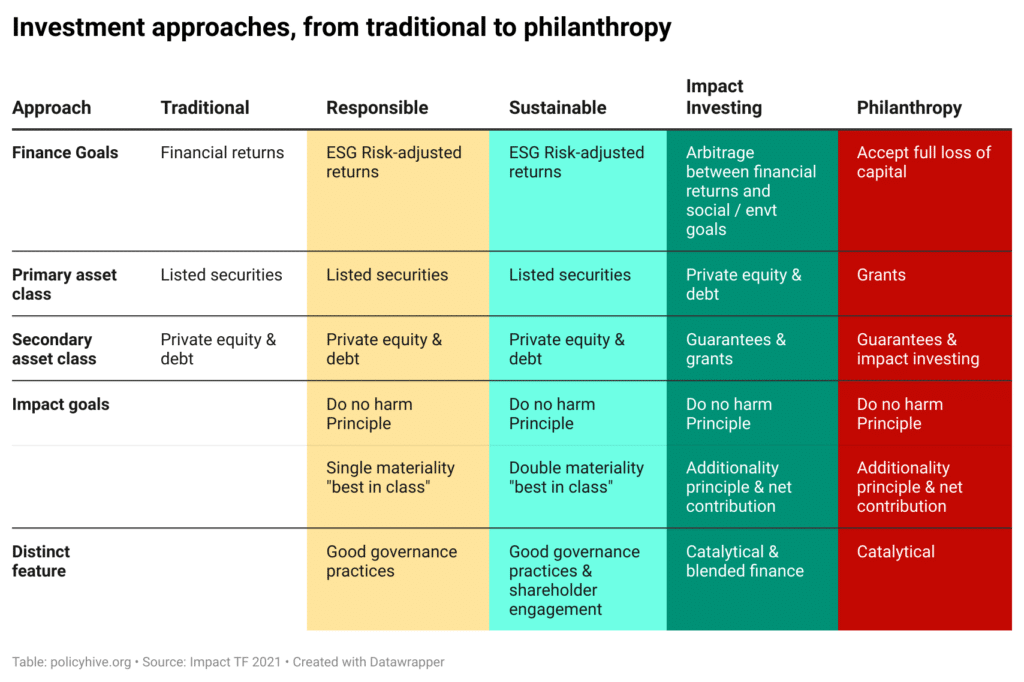

Impact investing is one category of investment practices that sits within a broader spectrum, ranging from traditional and purely financial motivated investment to responsible investment and to philanthropy.

One of the distinct feature of impact investing is the duty to demonstrate the “additionality” of the investment. In practice, this often includes a “catalytic function” which is common to development finance arrangements and blended finance.

There are various estimates of the size of the sector in the absence of a single set of metrics and definitions. The numbers fluctuate between USD100bn USD2tr. The figure of EUR500bn of assets under management is most commonly cited.

North America and Western Europe host the vast majority of impact investors. Geographic allocation also tilts much in favour of OECD economies.

Unsurprisingly institutional investors and banks account for a large share of investors in impact funds. By opposition, foundations and high net worth individuals represent less than 10%.

Impact investing funds include pure players and specialised investment firms but also mainstream asset managers and banks that are developing their own impact department.

Development finance institutions represent a small share in numbers, but are central to impact investing flows, accounting to approximately 27% of assets.