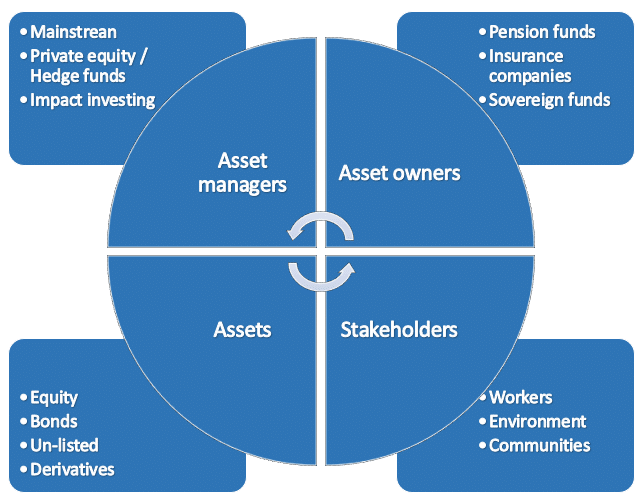

The investment chain

Which institutional forums matter when it comes to shaping policy and practices related to ESG and responsible investment in Europe? Mapping out these forums can be based on the “investment chain” that channels money from investors to the real economy. The chain is binding four category of stakeholders

- asset owners (pension funds, insurance companies, small investors, sovereign wealth funds),

- asset managers (mainstream, alternatives, impact funds),

- assets themselves (equities, bonds, unlisted) and the underlying businesses and projects of these assets, and

- employees, other workers (on-site or contracted) and external stakeholders (the environment, including climate and biodiversity, local communities).

It is a circular chain when the role of workers, and households at large, in financing asset owners is taken on board – through their pension rights, their investments in life insurance contracts and other long-term savings, or simply as citizens (as far as sovereign wealth funds and state-owned institutions are concerned). Thus, a pension fund is accountable to the workers who are members of the pension plan.

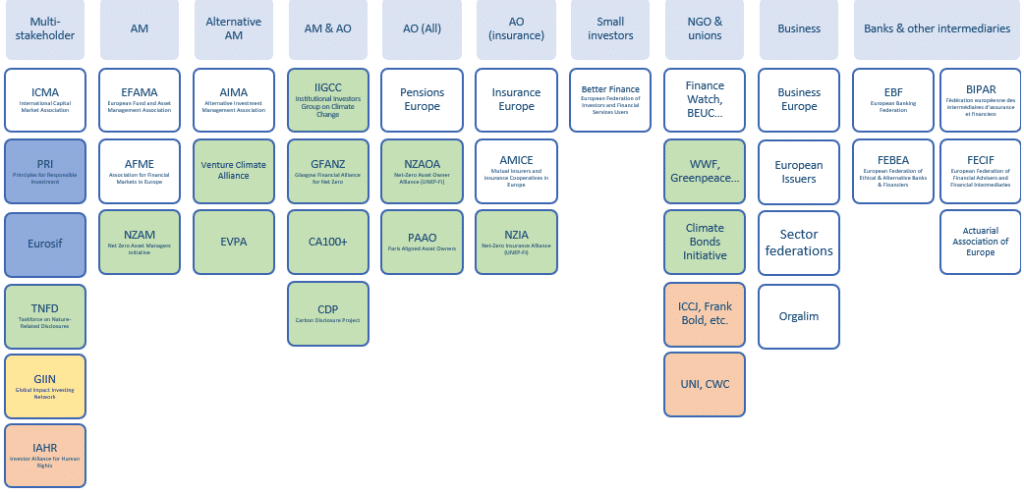

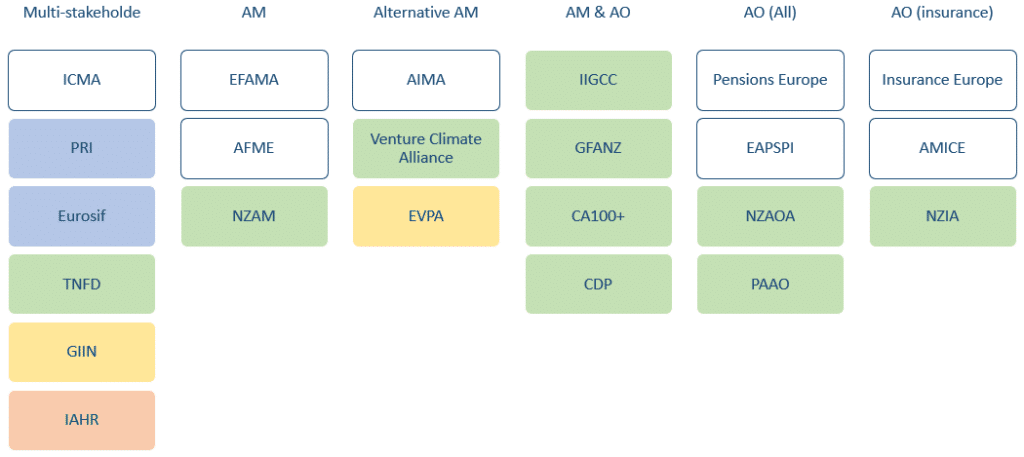

Mapping

All advocacy organisations dealing with ESG and responsible investment issues at EU level can be mapped on the basis of these distinctions along the investment chain.

Some forums are not specialised in ESG but cover all regulatory topics on behalf of there members, these included:

- EFAMA (European Fund and Asset Management Association), AFME (Association for Financial Markets in Europe) for asset managers,

- AIMA (Alternative Investment Management Association) for hedge funds and private equity,

- Insurance Europe for insurance companies, Pensions Europe for national pension fund federations.

Other forums are specifically dedicated to responsible investment, covering all three pillars of the ESG framework, including the UN PRI Principles for Responsible Investment and Eurosif, the EU umbrella for national sustainable investment forums.

The vast majority of forums however are focussed on climate, biodiversity and/or the environment at general. Around the UNEP-FI, the PRI and the IIGCC (Institutional Investors Group on Climate Change), several sister organizations have been formed aiming at carbon neutrality according to the Paris Agreement around the GFANZ (Glasgow Financial Alliance for Net Zero), including:

- the NZAM (Net Zero Asset Managers initiative) for asset managers,

- the NZAOA (Net-Zero Asset Owner Alliance) for asset owners,

- the NZIA (Net-Zero Insurance Alliance) and

- the PAAO (Paris Aligned Asset Owners) for pension funds and other long term asset owners.

Regarding transparency and reporting, there is the TNFD (Taskforce on Nature-Related Disclosures) which has taken over from the Task Force on Climate-related Financial Disclosures. One can also mention the specific forum for private equity, the Venture Climate Alliance.

Apart from climate and the environment, the forums dealing with other aspects of ESG are few.

- Some are specifically dedicated to impact investing: the GIIN (Global Impact Investing Network), the EVPA (Europe).

- On the trade unions’ side, there is the CWC (Committee on Workers Capital), but also UNI Global Union, one of the sector union federations, which has a team dedicated to responsible investment and shareholder activism.

- Outside the unions, there is the IAHR (Investor Alliance for Human Rights) coordinated by the American NGO Interfaith Centre.

Mapping NGOs is quite a challenging task given the diversity of the sector.

- In Brussels, in addition to the generalist NGOs, such as BEUC for consumers, and Finance Watch (financed by a coalition of NGOs and trade unions), there are the environmental heavyweights, Greenpeace, Friends of the Earth and WWF in particular.

- On the more specific subject of the due diligence and sustainability reporting, the role of ECCJ and Franck Bold should be highlighted.

Among the many active and innovative NGOs, the UK-based Share Action and the French Reclaim Finance should also be highlighted.