Public pensions in France would be equivalent to 14% of GDP, an alarming level for many observers. This figure comes from the OECD Economic Survey of France 2021. What concerns OECD economists is not so much the financial sustainability of the system, but the share in public spending, and in GDP points, compared to the OECD average.

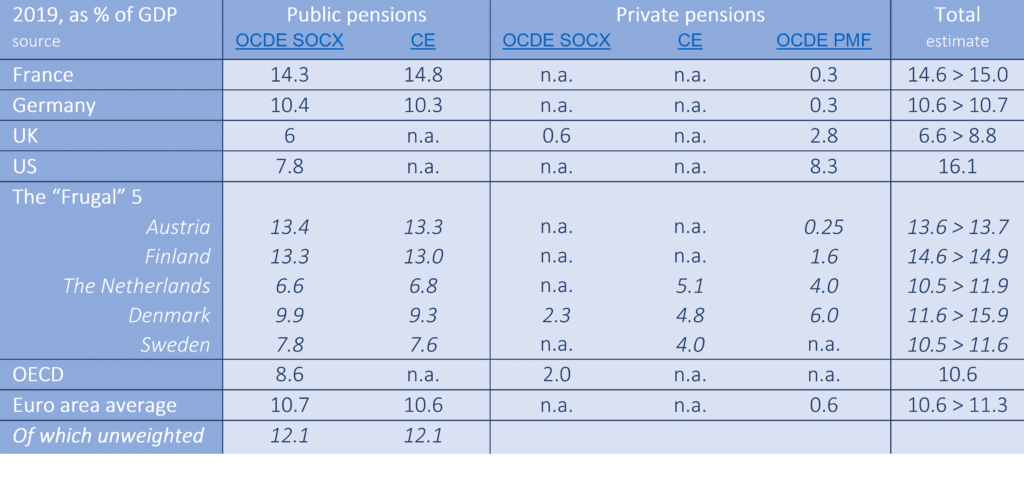

The comparison relates only to public systems and not to all pension systems (public and private). Taking private (pre-funded) systems on board, and with due care given to the low availability of data on private pensions, pension expenditure in France increases very marginally (+0.3%). On the other hand, they increase significantly, and quite logically, for countries that substantially rely on pre-funding.

The French pension system is comparatively very transparent, since it is based almost exclusively on the public pillar, and therefore on national accounts, whose data are available and complete. 14-15% of GDP may be a lot, but at least we know where we stand. For other countries, especially those that rely partly on pre-funding, we do not know too much, or we know less in relation to the available OECD data.

Regarding the sustainability of the system, the issue is on revenue- and contribution-side and hence on the employment situation. On that, the French labour market is abnormally concentrated around the 30-50 year age group, the employment rates before and after this age group being well below the OECD average. As for the debate on the retirement age, the minimum age for exercising rights is indeed 62 in France. But the “normal” age of departure, according to the harmonized definition of the OECD, is 64.8 years in France, that is… higher than the OECD (64.2 years) and European (64.5 years) averages.