Geopolitical risks feature unusually high in economic outlooks by international organisations. The challenge for economists is to predict and “quantify” the economic consequences of geopolitical tensions and armed conflicts. Broad trends can of course be drawn with respect to trade and investment flows (retrenchment) and to the efficiency of multilateralism (weakening and polarisation).

From an economic standpoint, and looking specifically at the consequences of an upcoming rearmament process and the expected increase in defence spending, there are two aspects to consider:

- The impact on fiscal policy: whether or not increased defence spending is making fiscal policy trade-offs more complicate. In times of fiscal consolidation and competing priorities, it could indeed crowd out growth and sustainable development-oriented spending in public education, health, infrastructure and climate transition. For Germany, Italy and Spain to raise their defence budget to 3% of GDP would be equivalent to almost 40% of their entire spending on public education.

- The impact on growth: whether a 1 euro spent on defence brings more, or less, economic benefits to economic growth relative to alternative public investment options. On that, the link between defence spending and economic growth is relatively underexplored in economic literature.

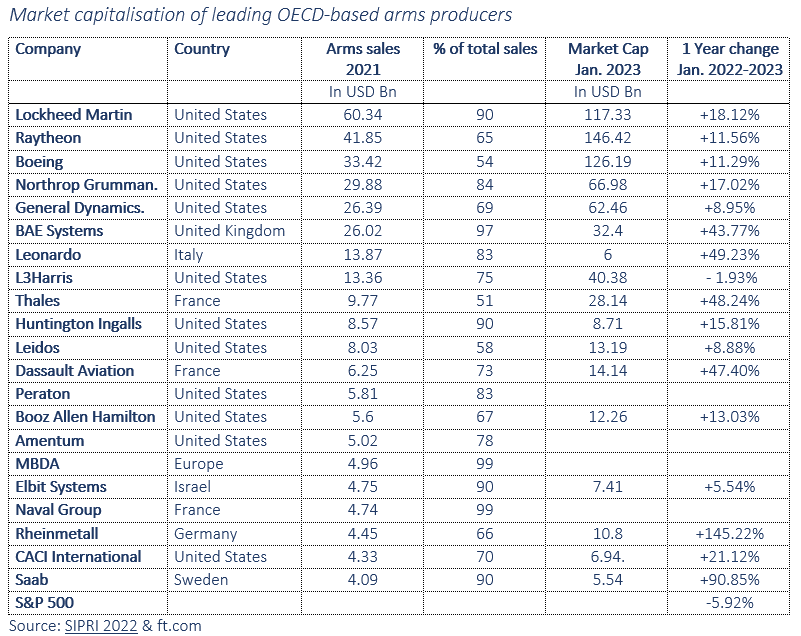

- Naturally the defence industry is expected to be a net beneficiary of any future rearmament process. Over the past 12 months, the S&P 500 contracted by over 5%. Yet nearly all the major arms producers saw their stock market capitalisation increased by at least +5%. European arms producers’ shares literally skyrocketed.