The global economy remains in recovery mode from the burst of high inflation of 2022 and monetary tightening that followed and is still under threat of rising geopolitical tensions and armed conflicts. For most regions and countries, GDP growth rates will remain far below the pre-Covid 2010-2019 averages. Much of the slowdown is due to China’s underperformance and to Europe, which should be close to a stand-still in 2024.

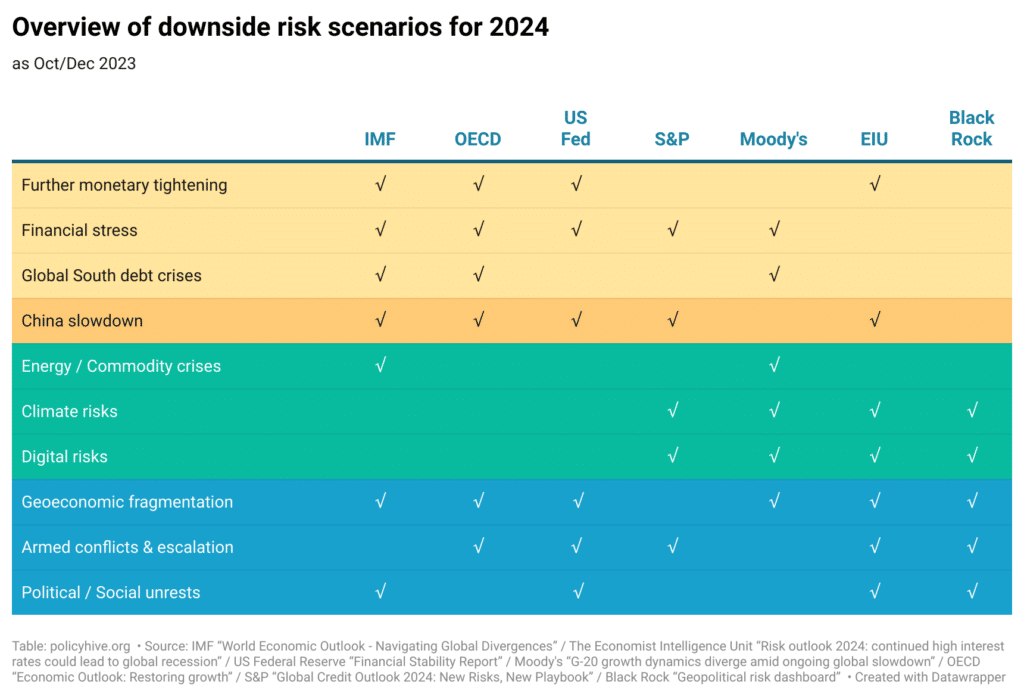

There are a number of downside risk scenarios to the baseline forecasts in recent economic and risk reports (IMF, Economist Intelligence Unit, Moody’s, Standard & Poor’s, OECD, US Federal Reserve Bank and Black Rock). Many of them are related to persistent inflation and the risk for excessive monetary policy responses. Related scenarios would see greater financial volatility and financial stress in the banking sector, as well as further strain on households, businesses and real estate. The possibility of a broader sovereign debt crisis in the Global South remains a central concern for the IMF.

Other than inflation and rising interest rates matters, the most cited stand-alone economic downside scenario is a more pronounced than expected slowdown in China in 2024, which would “hit global growth”, “cause ripple effects globally”, “strain markets worldwide”. By contrast, there are less reference to energy and commodity crises compared to previous editions of the outlook reports. Climate risks (both physical and transition risks) are mentioned, as well as cyber and AI risks.

The recent reports also highlight the continuing rise in the number of scenarios related to geopolitical tensions. “Geoeconomic fragmentation” resulting from strategic competition and decoupling between US and China would hamper both trade and multilateralism. And there are the unpredictable consequences of armed conflicts, the Gaza conflict adding to Ukraine in the list of conflicts that could escalate regionally.