According to the latest edition of the IMF World Economic Outlook, global growth is expected to hold steady at 3.3% in 2026 and 3.2% in 2027—a modest upward revision from the October 2025 forecast. Behind this apparent stability, a set of opposing forces are at play. Headwinds from shifting trade policies, and the Trump administration in particular, are for the time being offset by a surge in technology and AI investment, as well as accommodative financial conditions, as central banks conclude the monetary tightening cycle initiated to curb the 2021-2024 inflation surge.

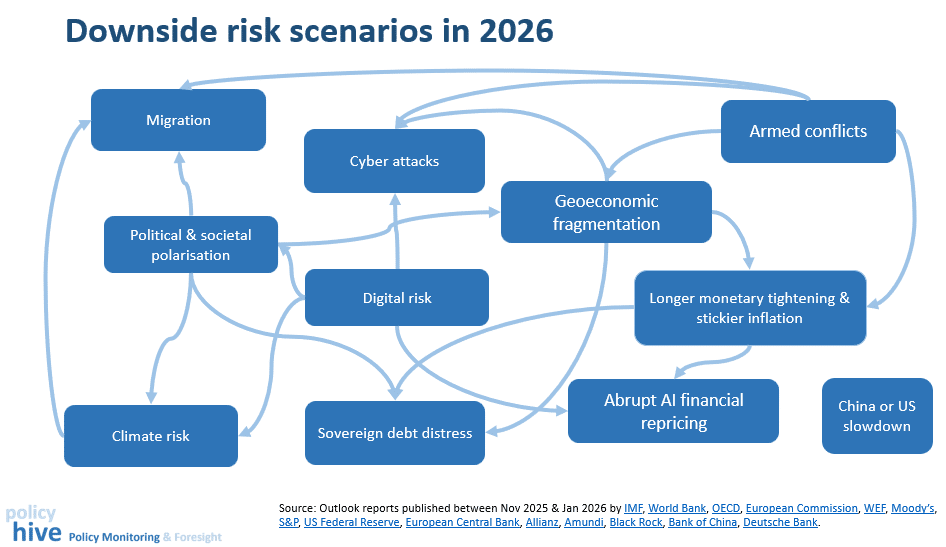

Every economic outlook report typically includes a set of key risk factors – or alternative forecasting scenarios – designed to contextualise the main projections and instil a degree of caution. By synthesising the scenarios and risk factors featured in recent reports from leading international organisations, a broader picture emerges of the principal threats to global growth in 2026 and beyond. To that end, 14 outlook reports published between November 2025 and January 2026 are reviewed, respectively from the IMF, the World Bank, the OECD, the European Commission, the WEF, Moody’s, S&P, the US Federal Reserve, the European Central Bank , Allianz, Amundi, Black Rock, Bank of China and Deutsche Bank.

Among the most frequently cited downside risks to the 2026 outlook, geopolitical tensions continue to feature prominently, reflecting their growing prominence in economic forecasting since February 2022. At the same time, risks linked to the digital transition and speculative investment in AI have moved to the forefront. The possibility of an “abrupt financial asset repricing”, potentially triggered by the bursting of an AI bubble, is a very serious scenario, one that some analysts compare to the 2007 subprime mortgage crisis.

Other notable risk scenarios include: persistent inflation prompting a new cycle of monetary tightening; sovereign debt distress; a sharp slowdown in a systemically important economy; climate-related risks (extreme weather events and transition risks); disorderly migration flows and tighter migration policies; cyberattacks; societal polarisation; and transition risks associated with the rise of AI.